IWANUS: Spike Protection Mechanism (SPM) does property owners no big favours

Retired assessor explains why 10-per-cent cap on assessment hikes is ludicrous

Happy new (taxation) year

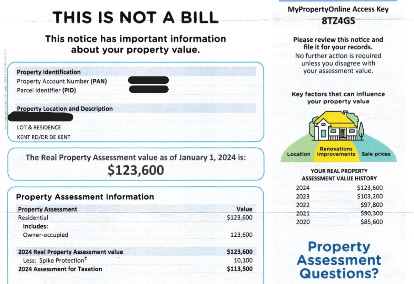

On your recently received 2025 property assessment notice, which Service New Brunswick (SNB) sent you, you’ll note the two values in the section entitled “Property Assessment Information.”

One is the “real property assessment value,” and the other is your “assessment for taxation.” Your tax bill will be based on the “assessment for taxation” value (note that the Department of Finance and Treasury Board [FTB] issues tax notices on March 1), and it’s created when SNB subtracts the “Spike Protection Mechanism” (SPM) from the “real property assessment value.”

For example, my own 2025 “real property assessment value” is $141,900. However, our “assessment for taxation” is only $124,800, which represents a 10 per cent increase from what the “assessment for taxation” was last year. FTB will, therefore, tax us on the $124,900, not the $141,900. (Note: don’t worry about how they do the calculations for the SPM – just make sure your 2025 “assessment for taxation” is no more than 10 per cent higher than last year’s).

What is the spike protection mechanism?

As per Service New Brunswick’s information on last year’s property assessment notice itself, “spike protection prevents your assessment for taxation from increasing by more than 10 per cent a year (excluding new construction, properties sold in the previous year, or major improvements)”.

At first glance, you might think that using the SPM to limit tax increases in a given year would be a good idea because, you know, less tax.

But is it? Well, the part about limiting tax increases in a given year is indeed a good thing, I’d argue. But using the SPM to do that? Not so much.

In fact, I think the SPM is as monumentally stupid and counterproductive a piece of public policy as there is in New Brunswick. There are several reasons for that.

Keep reading with a 7-day free trial

Subscribe to Northumberland Free Press to keep reading this post and get 7 days of free access to the full post archives.